Homeowners insurance covers damage to your home from fire, heavy wind, and other disasters.

-

- Homeowners insurance provides coverage in case a disaster damages your home or personal belongings.

- It can also pay out if you’re held responsible for an accident or injury.

- Home insurance generally covers damage due to fire, wind or snow, but it won’t cover floods or earthquakes.

Your home is more than just a roof over your head. It may be your most valuable asset — and one you likely can’t afford to replace out of pocket if disaster strikes. That’s why protecting your place with the right homeowner’s insurance is important.

What does homeowners insurance cover?

Homeowners insurance covers your house and belongings in case of events such as fires, hail, tornadoes, and burst pipes. If one of these scenarios damages your home, your policy can pay to repair it. Homeowners insurance can also reimburse you for theft or vandalism of your belongings.

But a homeowners policy doesn’t just cover your house and your stuff. It can also pay to defend you from lawsuits or cover medical bills for someone who gets hurt on your property. And if you can’t live at home after a covered disaster, your homeowner’s policy could pick up the tab for a hotel or rental apartment.

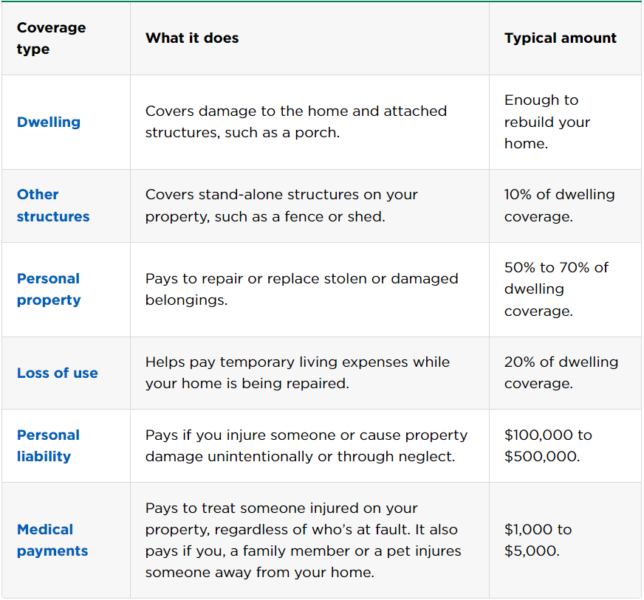

The 6 standard types of home insurance coverage

Standard homeowners insurance policies generally include these six types of coverage:

Dwelling coverage

Dwelling coverage covers the structure of your home, including the walls, floors, windows, and roof. Built-in appliances, such as furnaces, are typically included in your dwelling coverage. An attached garage, porch, or deck would fall under your dwelling coverage, too.

Which events are covered: Most homeowner’s policies cover your dwelling for any cause of damage that isn’t specifically excluded. According to the Insurance Information Institute, some of the most common causes of homeowners insurance claims include wind, hail, freezing, fire, and lightning.

How it works: A severe thunderstorm uproots a tree that falls onto your home, crushing part of the roof and attic. You’d pay your share of the repair cost — known as the homeowners insurance deductible — and then the insurer would pay the rest, up to your dwelling coverage limit.

Other structures coverage

Just like it sounds, other structures coverage provides insurance for structures on your property that aren’t attached to your house. That could include a shed, fence, or detached garage.

Which events are covered: As with dwelling coverage, most homeowners insurance policies cover other structures for any event that isn’t specifically excluded. That means you’d likely have coverage for fire, wind, hail, and snow, among other issues.

How it works: Part of your fence collapses under the weight of heavy snow. The insurance company would pay to repair it, minus your deductible.

Personal property coverage

Personal property refers to your personal belongings — like clothes, furniture, electronic devices, and appliances that aren’t built in. Most homeowners’ policies cover these items anywhere, not just inside your house. So if someone steals your bike from outside a store, it’ll likely be covered (minus your deductible).

Which events are covered: In most homeowner’s policies, personal property coverage works differently than dwelling and other structures coverage. Instead of covering your belongings for anything that isn’t specifically excluded, homeowner’s policies often cover only disasters that are listed.

These events, typically called “perils” in your policy, tend to include:

-

- Fire or lightning.

- Smoke.

- Windstorms and hail.

- Explosions.

- Theft.

- Vandalism.

- Weight of ice, snow, and sleet.

- Sudden damage from a power surge.

- Volcanic eruptions.

- Falling objects.

- Water overflow or discharge from household systems like plumbing, air conditioning, and appliances.

- Freezing of those same household systems.

- Sudden tearing, cracking, or bulging of a hot water system, steam system, air conditioning, or fire protective system.

- Riots.

- Damage from aircraft or vehicles.

How it works: A pipe bursts on a frigid winter night, sending water cascading into your kitchen and dining room. Although dwelling coverage would pay for damage to built-in items such as cabinets, personal property coverage would take care of ruined furniture, minus your deductible.

Loss of use coverage

Sometimes called “additional living expenses,” the loss of use a section of your homeowner’s policy can come in handy if your home is too damaged to live in. Loss of use coverage may pay for hotel stays, restaurant meals, or other expenses associated with living somewhere else if your home is uninhabitable after a disaster your policy covers.

Which events are covered: As long as your home is undergoing repairs for a covered claim, you’ll likely be eligible for loss of use coverage. But if your home’s damage is from a disaster that isn’t covered — such as a flood — your insurer won’t pay your additional living expenses, either.

How it works: After a kitchen fire spreads to your living room, your home is out of commission for a few months while contractors make repairs. Your insurance company would pay for you and your family to rent a similarly sized house nearby.

Liability coverage

Personal liability coverage offers financial help if you’re responsible for injuring someone or damaging their property. Coverage generally extends to anyone in your household, including pets — so if your dog bites someone at the park, you may have coverage. (See Does Homeowners Insurance Cover Dog Bites? for more information.)

Which events are covered: Liability insurance covers bodily injury and property damage to others, with some exceptions. For instance, your policy won’t cover criminal acts or harm you cause on purpose. Nor will it pay for injuries or damage from a car accident (your liability car insurance would cover those).

How it works: A delivery person slips on your icy sidewalk before you can salt it. He breaks his wrist in the fall and sues you for medical bills and lost wages. Your liability coverage could pay your legal fees, plus any damages you’re responsible for in the lawsuit, up to your policy limit.

Medical payments coverage

Like liability coverage, medical payments coverage pays if you cause physical injury to someone outside your household. However, you don’t need to be found at fault for medical payment coverage to pay out.

Which events are covered: You could tap your medical payments coverage if someone suffers a minor injury on your property or you cause harm to someone outside your home. Similar restrictions apply to liability and medical payments, with no coverage for intentional acts or car accidents, among other exclusions.

How it works: Your dog bites the hand of a visiting friend. There’s no serious harm, but your medical payments insurance covers the cost of their trip to urgent care for stitches.

What homeowners insurance won’t cover

Even the broadest homeowners insurance policy won’t cover everything that could go wrong with your home. For example, you can’t intentionally damage your house and then expect your insurer to pay for it. Policies also typically exclude damage from other causes such as:

-

- Flooding from external sources like heavy rainfall or storm surges.

- Drain and sewer backups.

- Earthquakes, landslides, and sinkholes.

- Infestations by birds, vermin, fungus, or mold.

- Wear and tear or neglect.

- Nuclear hazard.

- Government action, including war.

- Power failure.

However, you can buy separate coverage for some of these risks. Flood insurance and earthquake insurance are available separately, and in hurricane-prone states, you may need or want windstorm insurance.

Expand your coverage with endorsements

Talk to your insurer if you have concerns about problems your policy doesn’t cover. In many cases, you can add endorsements — which usually cost extra — that offer more coverage.

Below are a few of the most common home insurance endorsements. Note that availability may vary by state and company.

Scheduled personal property covers a specific valuable item such as a ring or musical instrument. You may need an appraisal — a document that states the value of the item — to get this coverage.

Ordinance or law coverage pays to bring your home up to current building codes during repairs or rebuilding.

Water backup coverage pays for damage due to backed-up sewer lines, drains, or sump pumps.

Equipment breakdown coverage pays for heating, ventilation, and air conditioning, or HVAC, systems, and large appliances if they stop working for reasons other than normal wear and tear.

Service line protection pays for damage to water, electricity, or other utility lines that you’re responsible for.

Identity fraud coverage pays expenses associated with identity theft such as lost wages and legal fees.

Does homeowners insurance cover …?

This table shows common problems and whether your homeowner’s insurance policy will cover them.

|

Problem |

Covered? |

Details |

|---|---|---|

|

Dog bites |

Usually. |

Your liability coverage typically covers expenses if your dog bites someone outside your household. See Does Homeowners Insurance Cover Dog Bites? |

|

Fallen tree |

Maybe. |

If a covered event knocks a tree onto your home, your policy will probably pay to remove it. But if the tree simply falls on your lawn, you’re on your own. Learn more about home insurance and tree removal. |

|

Fire |

Usually. |

Fire is one of the standard perils most homeowners insurance policies cover. Learn about home insurance and wildfires. |

|

HVAC problems |

Maybe. |

If a covered event such as a windstorm damages your heating or cooling system, your homeowner’s policy would likely pay to repair it. Adding an equipment breakdown endorsement to your policy could give you additional coverage for mechanical failures. However, homeowners insurance won’t pay for normal wear and tear. Learn more about homeowners insurance and AC units. |

|

Lost jewelry |

Usually not. |

A standard homeowners insurance policy covers jewelry only for theft, fire or other named events, not for accidental loss. That’s why it’s a good idea to add broader coverage for valuable jewelry. Learn more about jewelry insurance. |

|

Mold |

Maybe. |

It depends on the cause of the mold. Most insurers will cover mold only if it’s caused by a covered problem such as a burst pipe. Learn more about homeowners insurance and mold. |

|

Plumbing |

Maybe. |

Damage from sudden, accidental leaks may be covered, but slow leaks that develop over time generally won’t be. (The latter are considered a maintenance issue.) See Does Homeowners Insurance Cover Plumbing Problems? |

|

Roof leaks |

Maybe. |

It depends on why your roof is leaking. Insurance typically covers damage due to a sudden, accidental event such as hail or wind, but it won’t cover simple wear and tear. Learn more about homeowners insurance and roof leaks. |

|

Termite damage |

Usually not. |

Insurance companies generally consider dealing with infestations to be a part of regular home maintenance, which they don’t cover. Learn more about homeowners insurance and termite damage. |

|

Water damage |

Maybe. |

It depends on the type of water damage. Most home insurance policies won’t cover floods, for example. They won’t cover damage from a backed-up drain or sewer unless you’ve paid for that endorsement. But if a pipe freezes and bursts, your insurer will typically pay for the resulting damage. To learn more, see Does Homeowners Insurance Cover Water Damage? |

Types of homeowners insurance policies

Homeowners insurance comes in several types, called “policy forms.” Some types have more expansive coverage than others, so it’s worthwhile to know the difference. Note that different insurance companies may have different names for these policies.

Most popular: HO-3 insurance

HO-3 insurance policies, also called “special form,” are the most common. If you have a mortgage, your lender is likely to require at least this level of coverage.

HO-3 insurance policies generally cover damage to your home from any cause except those the policy specifically excludes, such as an earthquake or a flood. However, where it concerns your belongings, HO-3 insurance typically covers only damage from the perils listed in your policy.

Broadest coverage: HO-5 insurance

An HO-5 insurance policy offers the most extensive homeowners coverage. It pays for damage to your home and belongings from all causes except those the policy excludes. It’s typically available only for well-maintained homes in low-risk areas, and not all insurers offer it.

Limited coverage: HO-1 and HO-2 insurance

Much less popular are HO-1 and HO-2 homeowners insurance, which pay only for damage caused by events listed in the policy.

Other policy types include HO-4 insurance for renters, HO-6 for condo owners, HO-7 for mobile homes, and HO-8 — a rarely used type that provides limited coverage for older homes.

How homeowners insurance works

If your home is destroyed, your homeowner’s insurance company isn’t likely to simply write you a check for the amount listed on your policy. First, you’ll have to file a claim, documenting the damage. And your payout could vary depending on your coverage and deductibles.

Replacement cost vs. actual cash value

One key factor in your payout is whether your coverage will pay whatever it takes to rebuild your home, even if that cost is above your policy limits. This situation may arise, for instance, if construction costs have increased in your area while your coverage limits haven’t changed. Here’s a rundown of several options you may encounter.

Actual cash value coverage pays the cost to repair or replace your damaged property, minus a depreciation deduction. Most policies don’t use this method for the house, but it’s common for personal belongings. For items that are several years old, this means you’ll probably get only a fraction of what it would cost to buy new ones. Learn more about actual cash value coverage.

Functional replacement cost coverage pays to fix your home with materials that are similar but possibly cheaper. For example, your contractor could replace damaged plaster walls with less expensive drywall.

Replacement cost coverage pays to repair your home with materials of “like kind and quality,” so plaster walls can be replaced with plaster. However, the payout won’t go above your policy’s dwelling coverage limits.

Some policies offer replacement cost coverage for personal items. This means the insurer would pay to replace your old belongings with new ones, with no deduction for depreciation. If this feature is important to you, check the policy details before you buy. It’s a common option, but you typically need to pay more for it. Learn more about replacement cost coverage.

Extended replacement cost coverage will pay more than the face value of your dwelling coverage, up to a specified limit, if that’s what it takes to fix your home. The limit can be a dollar amount or a percentage, such as 25% above your dwelling coverage amount. This gives you a cushion if rebuilding is more expensive than you expected.

Guaranteed replacement cost coverage pays the full cost to repair or replace your home after a covered loss, even if it goes above your policy limits. Not all insurance companies offer this level of coverage.

Homeowners insurance deductibles

Homeowners’ policies typically include a deductible — the amount you must cover before your insurer starts paying. The deductible can be:

- A flat dollar amount, such as $500 or $1,000.

- A percentage, such as 1% or 2% of the home’s insured value.

When you receive a claim check, your insurer subtracts your deductible amount. Say you have a $1,000 deductible and your insurer approves a claim for $10,000 in repairs. The insurer would pay $9,000, and you would be responsible for $1,000.

Be aware that some policies include separate — and often higher — deductibles for specific types of claims such as damage from wind, hail, hurricanes or earthquakes. For example, a policy might have a $1,000 deductible for most losses but a 10% deductible for optional earthquake coverage. This means if an earthquake damages a home with $300,000 worth of dwelling coverage, the deductible would be $30,000.

Liability claims generally don’t have a deductible.

Source: nerdwallet.com ~ By: Sarah Schlichter ~ Image: Canva Pro