Interested in buying a home so you no longer have to send rent checks to your landlord each month? This thought isn’t surprising: real estate is attractive to both investors and those who want to swap renting for owning.

But while real estate is an attractive alternative or addition to stocks, bonds and mutual funds, it does come with risks and challenges.

Here’s a look at how real estate works, what makes it an attractive investment and the steps and research you need to take whether you’re buying a home for you and your family or making an investment to boost your bottom line.

Real Estate Definition

When you boil it down to the basics, real estate has a simple meaning. It’s a piece of land and the property – such as a house, office building, apartment, strip center or warehouse – that sits on it. These structures can be both above and under the ground. For instance, if you own a strip center with an underground parking lot, that parking lot would be part of your property.

Real Property Definition

If you’re buying real estate, you should also understand what the term real property means. Real property is the land and any structures affixed to it that are factored into the value of the property. For instance, if you own a home, its garage would be considered part of its real property. A movable picnic table in your backyard, though, wouldn’t. Real property also gives you the right to use your property, including selling it or leasing out space in it, as you wish.

Multiple types of real estate are available – whether you’re buying a home for yourself or to rent out to others. No matter what type of real estate you purchase, the hope is that it appreciates with time so that when you do sell, you earn a profit. Be careful, though: While real estate can be a sound investment over time, appreciation isn’t always guaranteed.

Residential Real Estate

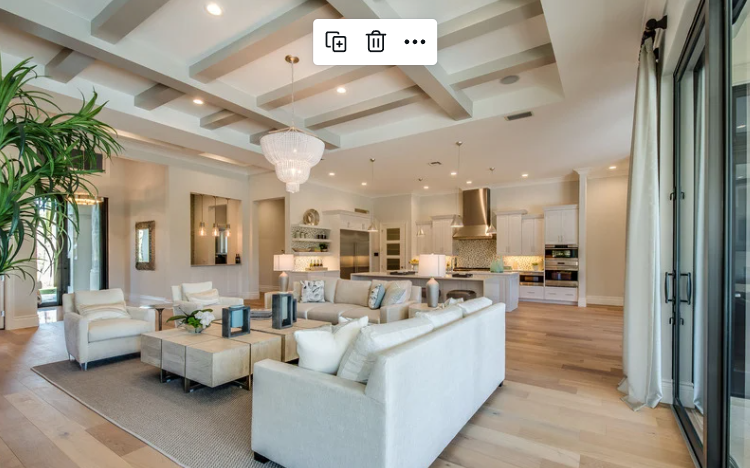

As its name suggests, residential real estate is any type of real estate where people can live, including single-family homes, townhouses, condominiums and multifamily homes.

Many people purchase residential real estate as a place to live. But you can treat residential real estate as an investment, too. You might buy a single-family home, renovate it and then sell it for a higher price. You can also buy a single-family home and rent it to tenants, collecting monthly payments to pay off the mortgage.

Even if you buy residential real estate primarily as a place to live, your home might still turn out to be a solid investment if it’s worth more when you sell than when you purchased it.

Commercial Real Estate

Commercial real estate is any property that provides a business service and isn’t used as a living space. This kind of property includes everything from office buildings and shopping malls to restaurants, clothing stores, movie theaters, gyms and gas stations.

You can earn money by holding onto the commercial property until it increases in value, then selling for a profit. Or you can earn money by leasing space in your property to business tenants. For example, if you owned a retail strip center, you’d charge that pizza restaurant monthly rent to lease space in it. If you owned an office building, you’d charge companies to lease space in the building.

You can also use commercial real estate as a home base for your own business. You might own an office storefront if you run an insurance business, for example.

Land

You can also buy land, which can be defined as real estate that has no buildings or structures on it. If you purchase land, you can then develop or build whatever you want on it, as long as you follow the local zoning codes and regulations for that lot.

Industrial Real Estate

Industrial real estate is any structure or piece of land primarily used for manufacturing facilities, warehouses, distribution centers and factories. This type of real estate can be pricey, but it’s also valuable.

As people spend more time shopping online, and as they expect the products they buy to show up at their doors in less time, the demand for industrial real estate has only grown. This makes this property type especially valuable since the odds of it appreciating in value are high.

Make Your Offer Stand Out!

If you’re ready to buy real estate – whether as a primary residence or an investment – it’s important to understand the basics of how this business works from start to finish.

Development And Construction

New buildings – everything from homes and office buildings to apartment towers, distribution centers and shopping malls – get their start during the development and construction phase of real estate. This is when development companies, municipal officials, architects, contractors, engineers and builders work together to create a new real estate project.

If you want to buy a home, it’s usually easier to purchase one already built. Buying land and building a new home on the site, though, can leave you with a home that more closely meets your housing needs. After all, you can tell your architects and builders exactly what you want.

Working With Brokerages And Real Estate Agents

You can purchase or sell real estate on your own. But navigating this process – finding the right property, qualifying potential buyers, signing documents and handling negotiations – can be time-consuming and confusing. So, this is where real estate brokerages, real estate agents and REALTORSⓇ come in.

Real Estate Agents And REALTORS®

Real estate agents are professionals who work with both buyers and sellers. Real estate agents who are members of the National Association of REALTORSⓇ are known as REALTORSⓇ.

Real estate agents help market properties, handle the buyer and seller negotiations and make sure all the right paperwork is signed during a real estate transaction. They don’t do this for free; they usually get paid a percentage of a property’s sale.

Real Estate Brokers

All real estate agents must work under a real estate broker. A real estate broker holds a real estate license and has extensive knowledge of the real estate industry. The term “brokerage” and “broker” often get confused with one another, but a broker is a real estate professional, and a brokerage is a real estate firm.

Property Management

If you buy real estate as an investment, you might opt to pay for a property management service. As the name suggests, such services manage rental properties that you purchase but don’t live in. They handle everything from maintenance and rent collection to emergency calls from renters at 2 a.m.

Let’s say you own an apartment complex in another state. You might hire a property management company to handle the maintenance of that property. This company would hire a landscaping service, cleaning service and security service. Your property management company might also screen potential tenants, market units when they come up for rent, and handle evictions if tenants stop paying their monthly rent. If a renter’s furnace conks out, one of your property managers would take the call and send out a repair service.

Working With Mortgage Lenders

Few people can purchase real estate with cash. Most people will have to take out a mortgage loan. This is where mortgage lenders come in.

If you want to buy a single-family home for a primary residence but lack the cash to make this purchase, you’ll work with a mortgage lender. You’ll provide this lender with income-verifying documents such as your most recent paycheck stubs, bank account statements and tax returns. Your mortgage lender will also check your three-digit credit score and your three credit reports, all to make sure you can pay back the money you borrow.

If you’re approved for a loan, your lender will pay the sellers of the property you’re buying. You then pay back your lender every month with a mortgage payment. You’ll have to pay interest on these payments, which is how lenders make a profit.

Lenders don’t originate loans for free but charge a range of fees to close your mortgage loan. Fees vary, but you can expect to pay 3% – 6% of your home’s purchase price in closing costs. On a home costing $200,000, then, you may expect to pay $6,000 – $12,000 in closing costs.

Investing In Real Estate

Ready to tackle real estate investing? Be prepared to do your research.

The key to maximizing your real estate investment is to study your local market. If you want to purchase a single-family home, for instance, you should study housing market indicators such as the median sales price of homes in your neighborhood, how long it takes homes to sell and whether home values are on the rise.

The same is true if you want to invest in commercial real estate such as a warehouse, office building or strip mall. You’ll need to research how much other owners are charging tenants for rents, how much traffic pours through retail areas and how high the vacancy rates are for neighboring office buildings or strip centers.

The more research you do, the better your odds of investing in a property that’ll increase in value over time and bring in a steady stream of rental income.

Ways To Invest In Real Estate

Of course, you can employ different strategies for investing in real estate. Let’s take a look at a few:

House Flipping

When some investors purchase single-family homes for a low price, they then flip these properties and sell them for a higher price. The key is to purchase a home for a low enough price and avoid overspending on improvements so you make a solid profit when you sell.

Rental Properties

You can buy a rental property and rent out apartment buildings, single-family homes, condo buildings and commercial properties. Your monthly rent collections might cover part or all of your mortgage payment, offsetting the costs of holding onto real estate while you wait for its value to rise. If you collect enough rent, you might make a monthly profit without having to sell your investment.

REITs

Buying into REITs – real estate investment trusts – is an easier way to invest in real estate. REITs are companies that own real estate, both residential and commercial. When you buy into a REIT, you purchase a share of these properties. It’s like investing in mutual funds, but instead of stocks and bonds, you’re investing in real estate. You earn money from REITs through regular dividend payments and when the value of a REIT increases. If the value goes up, you’ll earn a profit when you sell.

Real Estate Crowdfunding

In real estate crowdfunding, investors pool their money and then use it to invest in REITs, giving people who might struggle to come up with enough money to invest on their own a chance to invest in real estate.

The Pros And Cons Of Real Estate Investing

It’s easy to look at the advantages of investing when a big payout could be waiting in the end. But before you make an investment, let’s take a look at both the advantages and disadvantages of real estate investing.

The Pros Of Investing In Real Estate

Investing in real estate has plenty of potential advantages. By investing, you can:

- Expand your investment portfolio

- Bring in passive income

- Live in your real estate investment

- Get tax breaks

The Cons Of Investing In Real Estate

While investing in real estate can prove profitable, it can also:

- Be expensive to start

- Require selling property to gain funds

- Lack guaranteed profits

Real Estate FAQs

Keep reading below for answers to some frequently asked real estate questions.

What is a real estate broker?

As mentioned above, a real estate broker is essentially a step above a traditional real estate agent. They have additional education and have passed the broker license exam, allowing them to employ other real estate agents under their license.

How can I finance a real estate purchase?

Real estate is most often financed through a mortgage. There are many different types of mortgages and lenders, so if you’re thinking about purchasing real estate, be sure to research your options and find the ones that best fit your situation.

What is digital real estate?

Digital real estate is any website or other online asset. This internet property can be bought and sold similarly to traditional real estate.

The Bottom Line

Real estate involves many terms that are important to understand, and investing is one of them. Investing in real estate can be a smart financial move if you understand your market, are willing to take on the risks, and borrow only what you can afford to pay back.

Source: rocketmortgage.com ~ By: Dan Rafter ~ Image: Canva