Single Story Home Near University, North Turlock. Corner Lot with RV Storage and Access. 4 car tandem Garage. Approx. 1759sf, 2 Bedrooms with Potential 3rd (Currently Used as an Office with Closet). Remodeled Master Bathroom, Granite Counter tops throughout, and Laminate Flooring. Walking distance to all schools from Elementary, Junior High, Pitman High, and Stanislaus State. Vaulted Ceiling in the Living Area, Inside Laundry, and a Great Family Plan.

How Do I Find My Property Lines?

Determining property lines can provide you with information for needed legal changes to your home and backyard.

You may feel confident that you know your property lines just by looking at your house and yard. The neighbor’s fence and where you mow your grass all seem to match the boundaries between other houses on your street.

Now imagine being so wrong about your property lines that you learn your house is built on the completely wrong lot. Even smaller mistakes or discrepancies between documents can lead to costly issues if you and a neighbor disagree over the location of your property line. Here’s what you need to know about finding your property lines, and how to use the information once you get it.

Why Is Knowing Your Property Lines Important?

From permits to purchases, being able to identify your property lines accurately makes it much easier to complete a project or move forward with a transaction.

In most official cases, having a new survey done is the way to go. “Let’s say, for example, you want to build a swimming pool, and you’re not 100% sure where that easement is. You could have a new survey done,” explains Cynthia Durham Blair, a residential real estate closing attorney based in Columbia, South Carolina.

When you purchase a home, it’s not uncommon for your mortgage lender to require a new survey to be conducted on the property. Even when that’s not the case, your title insurance company will likely recommend a new survey as well, so you know if the neighbor’s garage reaches over onto the property or if the outdoor kitchen encroaches on a sewer easement, which could be costly to remove down the line.

Blair says issues discovered in a new survey of the property may not be covered in the standard owner’s title insurance policy, but knowing those concerns before you close could help you decide if you need to renegotiate with the seller or walk away from the deal entirely.

Who Dictates Property Lines?

Depending on how your neighborhood was founded, your property may have been separated from the land around it at the behest of a developer, by the city, county, or state, or even by a neighbor who chose to sell a portion of a large plot of land. A surveyor plays the vital role of establishing formal boundaries and marking them. When a property is legally split, the new property lines are established in a survey.

You and your neighbor may agree to change your property lines yourselves, though this involves a boundary line agreement, also called a lot line agreement, that involves deeding the land in question and changing the legal description of both your properties.

Check Your Deed

Before you fork over the cash for a new survey, there are a few ways you can find your property lines for free. Your property lines are noted in a few different locations, including in the legal description for the lot, which would be on your property deed and on a plat map, which is typically available through your local assessor’s office or planning office.

A property’s legal description is most easily found on the deed to the property, and there are a few ways the description can be written. It could simply describe the property’s exact location as it exists on the plat map, or it may include specific details with precise measurements that allow you to walk the property lines from a nearby reference point.

Review a Plat Map

A plat map shows property outlines for an entire neighborhood or area. On a standard residential street, you can expect to see rectangles all about the same size lined up on each side of the street, which signify each privately owned property. Every individual property will be labeled with an identifying number, which is the parcel number assigned when the lots were planned for separate sale, and follows surrounding parcel numbers in numerical order. Your deed should note the parcel number, but you can typically find the parcel information if you look up your home through your local assessor’s office. The plat map is also your best bet to find your property lines online, as your assessor’s office may provide plat map snapshots through its website.

Spot Survey Markers

Being able to perfectly translate the legal description to establish the physical boundaries on your property can be quite the feat if you’re not trained to do so. Many properties have hidden markers at the corners that, if found, can help you follow your boundaries. When a survey is conducted, the surveyor will leave flags or stakes at the metal markers, which are typically buried or have a cap sticking out of the ground.

“In the newest subdivisions, (homeowners) can kind of do it themselves if they’re comfortable with a tape measure,” says Jonathon Lord, managing partner for Carolina Land Surveying, based in Little River, South Carolina.

Search for Survey Pins

Even if your property doesn’t have visible corner markers, you may be able to hunt for the buried markers with a metal detector. The metal poles, often made of rebar, can be buried up to 10 inches below the surface. Use a metal detector until it indicates metal is there, then dig to be sure that what you’ve found is the marker.

Before you dig for the marker, be sure you know the location of any buried wires or irrigation systems to avoid causing damage. The universal phone number for U.S. homeowners to request buried utility information is 811, and with a few days’ notice, someone from your local utility company should be able to mark county wires or pipes with spray paint.

Even if you know the location of your property lines, you should be sure of the location of any buried utilities before starting a project that requires digging. The Common Ground Alliance, which aims to reduce damage to underground infrastructure, operates Call811.com as an additional resource to help people across the U.S. and Canada know where utilities are located before digging.

Hire a Surveyor

For existing residential properties, a surveyor specializes in making precise measurements to locate the legal boundaries of a plot of land and any improvements to the property, from the house and driveway to a swimming pool or backyard shed.

Taking the details from the legal description and plat map, a surveyor carefully measures the legal boundaries of your property. The surveyor will bury survey pins if they’re not already there and often mark the spots with stakes or flags for easy use.

The complexity of a survey depends on the geography of the area, what’s on your property, and what surrounds it. In an area where homes were built relatively recently and there are few trees, a survey could be completed as quickly as 30 to 45 minutes, says Mike Stanley, owner of Stanley Land Surveying, based in the Huntsville, Alabama, metro area.

But in an older neighborhood, where lots of properties have fences and established trees, “a half acre could take you two to three hours,” he says.

HomeAdvisor reports the typical price range to hire a land surveyor is between $375 and $744, with the national average at just about $525. Depending on the size of your property and where you live, you could see that price rising past $1,000, according to HomeAdvisor.

Avoid Trusting Fence or Driveway Boundaries

Don’t use fence lines, driveway boundaries or your neighbor’s garden as a point of reference. Just because you’ve assumed that’s where your property ends don’t mean it’s accurate. “If the fence was built and they didn’t get a survey, they built it where they thought the line would be” rather than where it actually is, Stanley says.

Look at Sidewalk Cuts and Streetlights

If you’re looking for clues as to where your property might start and end, streetlights or telephone poles at the road are commonly placed on property lines. Similarly, many cities will follow property lines when pouring concrete for sidewalks by including a cut at the property lines, making each property have a complete number of sidewalk squares.

While these details may be more reliable than following your neighbor’s fence, they’re still not always accurate. Don’t consider breaks in the sidewalk or the location of a streetlight as a definitive marker of your property line without checking the survey first.

Can You Locate Your Property Lines Online?

The publicly recorded documents that can help you find your property lines are typically available online through your local assessor’s office. These include the deed, which includes the legal description of your property and the plat map, which will show an outline of your property with others in the area.

How to Handle Disputes Over Property Lines

If you and your neighbor disagree about the location of your property lines, the quickest solution is to hire a surveyor to provide a definitive answer.

If your neighbor is encroaching on your land and refuses to stop, you may want to enlist the help of a real estate attorney. Without action, enough time could pass to make the encroachment a prescriptive easement, which can mean that you lose the right to require your neighbor to remove a fence or stop using the portion of your property.

Source: realestate.usnews.com ~ By Devon Thorsby ~ Image: Canva Pro

Equity Gains for Today’s Homeowners

Today’s homeowners are sitting on significant equity, even as home price appreciation has eased recently. If you’re a homeowner, your net worth got a boost over the past few years thanks to rising home prices. Here’s what it means for you, even as the market moderates.

How Equity Has Grown in Recent Years

Because of the imbalance between how many homes were for sale and the number of homebuyers in the market over the past few years, home prices appreciated substantially.

And while price appreciation has slowed this year, that doesn’t mean you’ve lost all the equity in your home. In fact, the latest Homeowner Equity Insights report from CoreLogic finds the average homeowner’s equity has grown by $34,300 over the past year alone.

And if you’ve been in your home longer than that, chances are you have even more equity than you realize.

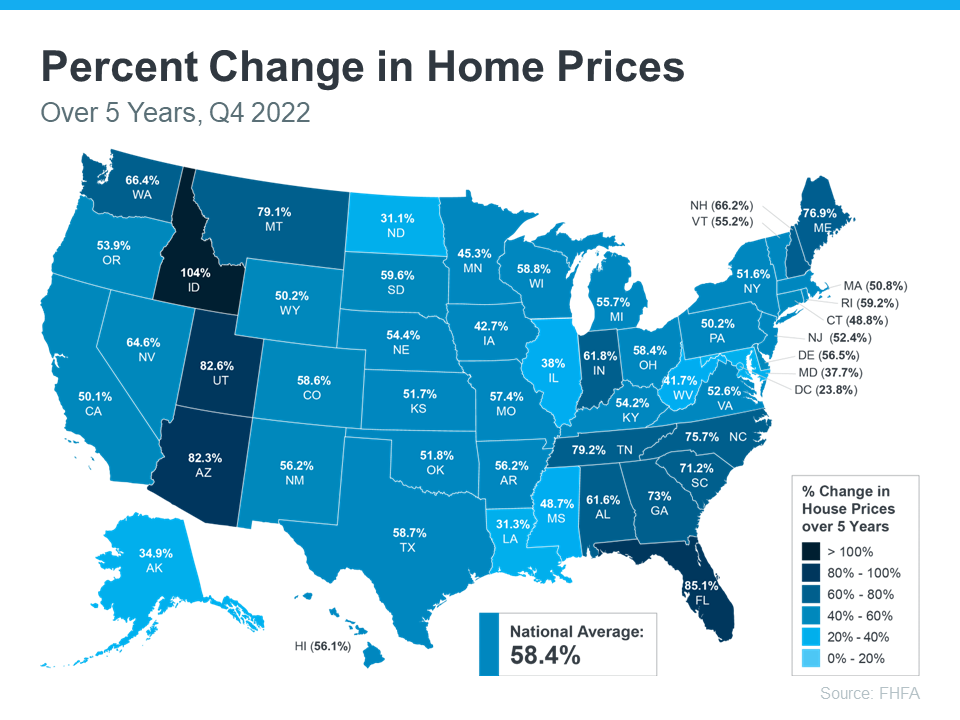

While that’s the national number, if you want to know what happened in your area, look at the map below from the Federal Housing Finance Agency (FHFA). It shows on average how much home prices have risen over the past five years, which has been a major driver behind equity growth.

Why This Is So Important Right Now

While equity helps increase your overall net worth, it can also help you achieve other goals, like buying your next home. When you sell your current house, the equity you’ve built up comes back to you in the sale, and it may be just what you need to cover a large portion – if not all – of the down payment on your next home.

So, if you’ve been holding off on selling, it may be time to find out how much equity you have and how it can help fuel your next move.

Bottom Line

Homeownership is a long game, and if you’re planning to make a move, the equity you’ve gained over time can make a big impact. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, connect with a local real estate professional.

Source: keepingcurrentmatters.com ~ Image: keepingcurrentmatters.com

SOLD – 19535 Rexham Ct. Hilmar

How Does Escrow Work When Selling a House?

It is highly probable that you will have to familiarize yourself with the escrow process if you are selling a home. Whether you have built one house or have a list of homes you want to sell, each real estate transaction will be finalized through the escrow process.

Escrow agents will handle the release of the property to the buyer of the new home, as well as the release of the funds for the new home sale once the transaction is closed. In this article, we will go over exactly what the process to sell your home(s) with an escrow service in California entails.

New Home Sale Escrow Process, Step-by-Step

Below, you will find the steps of the escrow process for a new home sale. Although this process outlines the escrow process for the state of California, the list of steps written below can be applied to other states as well.

How to successfully close a new home sale escrow transaction

- First, with the assistance of the escrow company, you will set up the terms of the escrow agreement with the buyer of the new home.

- The buyer will deposit all the agreed-upon funds into the escrow account, covering the full sales amount of the home, plus any additional fees.

- The buyer will then present all relevant documentation to the escrow company to uphold the real-estate agreement.

- The seller will deposit a deed to the property that names the buyer as the owner of the new home.

*This deed is crafted by the escrow company to meet all federal and state guidelines.

- Then, the seller will present any additional required documentation to close the new home sale.

- If the above conditions are met within the stated escrow timeline, the transaction closes and the property ownership is recorded to the new buyer.

How Much Does Escrow Cost for a New Home Sale?

Many wonder about the actual cost of using an escrow service. Although the price depends on each specific transaction as well as the state it is being held in, a real-estate escrow process normally costs between 1% and 2% of the transaction price.

It is important to remember that the price you see an escrow company charge might not always be the full price you end up paying for your escrow service. Many escrow companies will add hidden fees on top of the percentage of the transaction price. To avoid this problem, choose an escrow service that is fully transparent with prices.

The escrow process can get even more expensive if things go wrong during a transaction. An escrow process that drags out can be emotionally draining for sellers that have spent years building a new home they want to be sold, making it all the more important to choose an escrow service that is fast and efficient.

How Long Does Escrow Take for a New Home Sale?

As mentioned before, the escrow process can drag out considerably depending on a variety of factors, including state laws, what parties have agreed to, and who the escrow service provider is. In the hands of the right escrow agent, however, the new home sale escrow process shouldn’t take more than 30 days.

Should be a 30 Day Escrow Process

New home sales that take longer than 30 days to finalize will leave both parties in the escrow agreement in limbo while money sits in an escrow account. This can not only add extra costs to the escrow process but will leave all parties involved extremely frustrated. The emotional cost of a bad escrow should also be calculated when choosing an escrow provider.

Choosing The Right Escrow Service

The escrow process timeline depends largely on your specific transaction. However, it is also crucial to choose an escrow service that guides you through the entire process and implements technology that makes the escrow process fast, easy, and effective.

If you are selling homes and need an escrow provider to manage the transaction, then New Venture Escrow offers the easiest and fastest escrow in California. Contact our escrow experts and we will guide you through the escrow process for a new home sale. If you just need more help and want to learn the escrow process for a home resale or how escrow works when refinancing, check out the other resources available on our website.

SOLD – 1800 W Glenwood Ave, Turlock

Ranchette-3.7 acres. Stunning 3 bedroom/2 bath home with detached 20×40 garage with 9 ft doors. Fully remodeled. The kitchen features new cabinets, stainless appliances, and quartz counters. The list is long – all new flooring, plumbing, electrical, windows, doors, fixtures, and interior/exterior paint. Both bathrooms have been updated. Indoor laundry, new pump house, and fenced pasture. This is a Beautiful home. Enjoy the country life, close to town. Rare opportunity you don’t want to miss!

SOLD -1955 E Tuolumne Rd. Turlock

SOLD – 9321 Meadow Dr. Winton Ranchette

9321 Meadow Drive Winton, CA, 95388 Custom Ranchette!! Shop, Tennis Court, Pool…This Newly Remodeled Home is over 3500sf with a Newer Kitchen, Floors, Roof, HVAC, Bathrooms, and More. This Beautiful One-story Home is Secluded and Nestled in a Park-like Setting. Lots of trees surround this property offering Privacy with Special Views. Metal Shop (80×40) with 4 roll-up doors, Insulated, and Alarm. Nice, Elevated Pool Area this’s Perfect for Family Fun and Entertaining. Large Tennis court that could easily be used as a Basketball Court. Great Kitchen with New Cabinetry, SS Appliances, New Counter Tops, and more. Large Living room and Space. Huge Laundry/Mud Room. Master Suite has a Huge Walk-in Closet and a Newly Done Master Bathroom. This 4 bedroom, 3 Bath Home is Ready for Your Family. An Organic, Private Garden area with lots of Fruit trees. A Must See!! This has it All!!!

SOLD – 2531 Riverdale Avenue, Modesto, CA, Church Bldg

2605 E Hawkeye Ave. Turlock, 4 bed/4 bath/4,161sqft/0.24acre lot