Last year may go down in real estate history as the year of correction. After a pandemic-fueled, seller-benefitting boom — with bidding wars, inventory shortages, and spiraling prices all over the country — the housing market began to cool down in 2022. The impact of inflation and fast-rising interest rates dampened buyers’ interest, causing sales to slow and price appreciation to decelerate.

All this made 2023 something of a transitional year. And now, in 2024, inflation is much lower but home prices and mortgage rates are both still high. Sellers still have an edge in many areas, thanks to a continued scarcity of houses, and no one expects a dramatic housing market crash. Still, many analysts see a shift coming toward a more balanced market, which would benefit buyers.

Whatever the economic state of the real estate market, buying a house can be an exciting and emotional process. Before starting your search, be sure you understand the ins and outs of homebuying, so you can make the best decisions for your family — and your wallet. Here’s what to know when buying a house, one step at a time.

Buying a house: A step-by-step guide

1. Determine why you want to buy a house

Purchasing a home is a major decision that shouldn’t be taken lightly. If you’re not clear on exactly what you want out of homeownership, you could end up regretting your choice.

Get started: Define your personal and financial goals. “Buyers should think about when they intend on moving and what they want in a home — amenities, ideal location, and how long it could take them to save for a down payment,” says Edwence Georges, a real estate agent with RE/MAX in Westfield, New Jersey. “These are all important to help define the goals they would like to meet.”

-

- Make a list of what’s important to you in a home. Is location the top priority? Any must-have amenities?

- Analyze whether it makes sense for you financially. Would renting for another year or two improve your financial standing?

- Be sure you’re prepared for the ongoing expenses of maintaining a home.

2. Check your credit score

Your credit score will help you determine your financing options; lenders use it (among other factors) to set the terms and rates of your loan. The higher your score, the lower the interest rate you will be eligible for — lower scores equate to more expensive mortgages.

Get started: You can get your credit report and score from each of the three major credit reporting agencies, Equifax, Experian, and TransUnion, for free once a year. Your bank or credit card company might offer free access to your score or credit report, too. If you discover any discrepancies, contact each agency and report the error.

-

- Consider how different credit score ranges impact your interest rate, monthly payments, and total interest.

- Pull your credit reports from each of the credit bureaus for free every 12 months at AnnualCreditReport.com.

- Learn other ways to get your free credit report and score.

3. Save for a down payment

To avoid having to pay private mortgage insurance or PMI, you’ll need to put down at least 20 percent of the home’s purchase price for a down payment. Some lenders offer mortgages without PMI with lower down payments but expect to pay a higher interest rate. Be sure to do your research: Many types of loans require a much lower minimum down payment, and there are many government programs to help cover down payment costs for qualified buyers. Shop around carefully based on how much you’re able to pay upfront.

Get started: Research the requirements for the loan you want so you know exactly how much you’ll need to save for a down payment. If a friend, relative, or employer has offered to provide a down payment gift, initiate a conversation early on to learn how much they plan to contribute and if there’s any shortfall you’ll need to cover — and secure a gift letter from them well in advance.

-

- Consider options backed by the federal government. If you qualify for an FHA, VA or USDA loan, your down payment minimum will be considerably lower than 20 percent.

- Conventional loans offered by Fannie Mae and Freddie Mac, meanwhile, require just 3 percent down.

- Look into local and state down payment assistance programs to see if you’re eligible for a cost-saving loan or grant.

4. Create a housing budget

The purchase price and down payment aren’t the whole picture. Setting a realistic budget for your new home will help inform how much you can afford and what your all-in costs will be.

Get started: Carefully consider other expenses to determine what you can afford long-term. “Buyers tend to forget to factor in other costs, like homeowners association fees and maintenance,” says Paige Kruger, Realtor and founder of Signal Real Estate in Jacksonville Beach, Florida. “Just because you can afford a mortgage and a down payment doesn’t mean you can afford those long-term costs after you move.”

-

- Figure out how much you can set aside for a down payment, plus a buffer fund for ongoing or unexpected maintenance costs.

- Determine the maximum loan you qualify for. Getting pre-approved can help (see Step 5).

- Analyze your monthly budget to make sure you can handle mortgage payments along with your other day-to-day bills.

5. Shop for a mortgage

Getting pre-approved for a mortgage gives you a firmer handle on how much you can afford, and it’s helpful when you make an offer on a house because it shows sellers you’re financially qualified. Once you’re ready to apply for official approval, you’re not obligated to stick with the same lender that issued your preapproval — compare the terms and rates offered by several companies.

Get started: Shop around with at least three lenders or a mortgage broker to increase your chances of getting a low-interest rate. Sign up for a Bankrate account to determine the right time to strike on your mortgage with our daily rate trends.

-

- Work with an experienced mortgage lender who can walk you through all the options and overall costs.

- If you’re a first-time homebuyer, inquire about what programs or incentives might be available to you.

6. Hire a real estate agent

An experienced real estate agent can save you time and money by helping you find the right home and negotiating with the seller on your behalf. Agents are licensed professionals who know their markets well and can guide you through your homebuying journey.

Get started: Contact several local real estate agents and talk with them about your needs before choosing one. “Someone with knowledge of an area can tell if your budget is realistic or not, depending on the features you desire in a home,” Kruger says. “They can also point you to adjacent areas in your desired neighborhood or other types of considerations to help you find a house.”

-

- Before hiring an agent, ask about their track record and knowledge of your desired neighborhood.

- Inquire about their workload as well. You don’t want someone who is over-scheduled.

- Bankrate can help match you with a qualified agent in your area.

7. Go house-hunting

Viewing listing photos online is helpful, but isn’t a substitute for visiting homes in person and getting to know the area and its amenities. In some cases, the right neighborhood might be even more important than the home itself.

Get started: Be specific with your agent about exactly what kinds of homes you want to see, so they can more effectively find options that meet your criteria. Keep an open mind: You may not be able to check off everything on your wish list, so prioritize must-haves over things that are nice to have but not crucial.

-

- Explore neighborhoods you like to see what’s for sale, and attend open houses for homes that pique your interest.

- Take notes on each property you visit — after a few, they can start to blend together in your mind.

- Keep your schedule open so you can pounce when a great home is listed, especially in a competitive market.

8. Make an offer

Understanding how to make an attractive offer on a home can help increase the chance of it being accepted, putting you one step closer to getting those coveted keys. Confer with your agent and let their expertise lead the way.

Get started: Once you find “the one,” your real estate agent will help you prepare a complete offer package, including your offer price, your preapproval letter, proof of funds for a down payment (this helps in competitive markets), and terms or contingencies.

-

- Think carefully about what contingency clauses to include in your contract. Common real estate contingencies can hinge on financing, appraisal, home inspection, and more.

- It’s not unusual for sellers to make a counteroffer. You can respond if you wish to keep negotiating, or reject it and move on.

- Once an offer is accepted, you’ll sign a purchase agreement and pay an earnest money deposit, typically 1 to 2 percent of the purchase price. The funds will be held in escrow until closing.

9. Get a home inspection

A home inspection provides an overall picture of the property’s condition and any mechanical or structural issues it might have. This will help you determine how to proceed with the closing process: If major problems are found, you might want to ask the seller for repairs — or, if there’s an inspection contingency in the contract, you might even decide to back out of the deal.

Get started: Your agent can probably recommend a home inspector, but do your homework before choosing one. Depending on your contract and what state you’re in, you’ll generally need to complete the inspection within 10 to 14 days of signing a purchase agreement.

-

- Check the inspector’s experience by reading online reviews, asking for client references, and looking at their credentials.

- To understand what is and isn’t covered, read Bankrate’s home inspection checklist.

- Fees can vary, but according to HomeAdvisor, you’ll likely pay somewhere between $281 and $403. The average is $342.

10. Negotiate repairs and credits

Your home inspection may reveal a few issues, especially if it’s an older home. Major problems might need to be dealt with before your mortgage lender will finalize your loan, and it’s common to negotiate for the seller to either pay for the repair or offer the buyer a credit to cover the cost.

Get started: Enlist your agent’s help with this — the need for repairs is not unusual, but negotiation can be delicate work and is best left to the pros. They will work with the seller’s agent to come to an agreement about repairs or credits.

-

- Hazardous problems like structural damage or improper electrical wiring could keep your lender from approving your loan, so take the solutions very seriously.

- Some sellers won’t agree to extensive repairs. That’s why a home inspection contingency is important — it gives you a way out of the deal if you need it.

11. Secure your financing

A preapproval is not the same thing as official approval. Getting final loan approval means you need to keep your finances and credit in line during the underwriting phase. Don’t open new credit lines or make any major purchases until the paperwork is signed, and avoid changing jobs before closing too, if possible.

Get started: Respond promptly to requests or questions from the lender, and double-check your loan estimate to ensure all the details are correct. You may need to submit additional paperwork as your lender completes the process, such as bank statements, tax returns or additional proof of income, so keep your paperwork organized.

-

- Being preapproved doesn’t mean you’re in the clear — that’s not the case until a lender has given your loan the final stamp of approval.

- Keep your finances and credit in good shape from preapproval until closing day.

- Avoid running up credit cards, taking out new loans or closing credit accounts too. These things can hurt your credit score or impact your debt-to-income ratio, which can imperil your final loan approval.

12. Do a final walk-through

A final walk-through is your opportunity to view the property one last time before it becomes yours. This is your last chance to address any outstanding issues before the house becomes your responsibility.

Get started: Your agent will schedule the walk-through for shortly before closing. Bring your home inspection checklist and other documents, like repair invoices and receipts, to ensure everything was done as agreed and that the home is move-in ready.

-

- Ask your agent to attend with you — they can act as a witness and help answer any questions.

- If any problems remain, have your agent communicate immediately with the seller and your lender. Your closing date might have to be delayed to ensure those issues are remedied first.

13. Close on your house

Once all contingencies have been met, you’re happy with the final walk-through and your lender has declared your loan “clear to close,” it’s finally time to make it official and close on your new home. After all of the paperwork has been signed, the home is officially yours and you’ll get the keys. Congratulations!

Get started: Three business days before your closing date, the lender will provide you with a closing disclosure that outlines your loan details, such as the monthly payment, loan type and term, interest rate, loan fees and how much money you must bring to closing. You will attend the closing along with your real estate agent, possibly the seller and their agent, and the closing agent, who may be a representative from the escrow or title company or a real estate attorney. This is also when you’ll wire your closing costs and down payment, depending on the escrow company’s procedures.

-

- When you get your closing disclosure, compare it to your loan estimate to ensure the terms are the same. Ask any questions and correct any errors before you sign the paperwork.

- On closing day, review all the documents you sign carefully, and ask for clarification on anything you don’t understand.

- Make sure you’re given all house keys, entry codes, and garage door openers before leaving the closing.

Other things to consider

Is it the right time to buy?

Traditionally, spring is the start of the homebuying season, with many listings hitting the market and activity peaking over late spring/early summer. However, your own financial readiness is more important than the time of year.

Mortgage rates recently hit highs not seen in more than 20 years. Meanwhile, strong demand for homes has pushed prices higher and frustrated many potential homebuyers. This combination of high rates and high prices has plenty of people wondering whether they should try to buy a home now, or wait for things to settle down.

The answer likely depends on your own personal circumstances more than the condition of the housing market. If you’re financially stable, you have enough in savings to cover the down payment and other expenses, your employment and income are secure, and you’re ready to stay in one place for a while, then now is a perfectly fine time to buy a house. You can always refinance if rates drop significantly. On the other hand, if your savings are tight or your credit score is less than stellar, it might make more sense to take time to build those before buying.

One thing to keep in mind: Be sure to exercise caution anytime there’s a spike in home prices. “Be careful about buying near the top of the market, especially if you want to be in the home for only a few years,” says Ken H. Johnson, a real estate economist at Florida Atlantic University and co-author of the Beracha, Hardin & Johnson Buy vs. Rent Index. If you’re looking to buy under these conditions, says Johnson, “bargain aggressively and be willing to walk away.”

What’s your local market like?

The area you’re house-hunting in has a major impact on what to brace for as a homebuyer. Each market has its own quirks to consider: For example, the taxes, cost of living, job market and housing situation in California will yield different buying conditions than in Texas or Ohio. And even within the same city, real estate is very localized — you might be surprised by how drastically market conditions can vary from one neighborhood to the next. This is why partnering with a knowledgeable local agent who understands the intricacies of their market is so important.

How prepared are you for extra costs?

The down payment is often considered the biggest homebuying expense, since it’s a large amount that the buyer has to actually pay upfront. But homeownership involves plenty of additional costs that you should be ready for. Before you even close on the purchase, you’ll need to make sure you have enough money set aside to cover closing costs. These fees will vary by state and by individual transaction, but they will almost certainly range into the thousands of dollars.

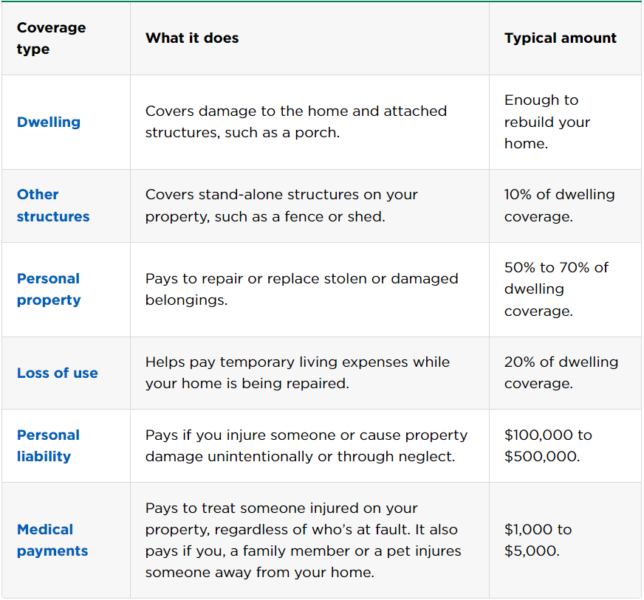

When budgeting for your monthly housing costs, factor in not only the principal and interest amounts of your mortgage payment, but also property taxes, home insurance premiums, and homeowners association fees (if applicable), plus private mortgage insurance if you’re putting down less than 20 percent. And don’t forget to set aside money for ongoing maintenance and unexpected repairs, too.

Source: bankrate.com ~ By: Jeff Ostrowski ~ Image: Canva Pro