$5,900,000 – Turlock 24.97 Acres of COMMUNITY COMMERCIAL!! Near Highway 99 and within the City of Turlock. A Perfect spot for an Entertainment Center, Hotel, or Planned Development to Complement all the Nearby City Services. It’s Near Costco and Other Big Box Retailers and Across the Street from Turlock’s Petretti Sports Complex. This Corner Parcel is between and accessible off Highway 99 through Monte Vista or Fulkerth. Lastly, it has Highway Exposure/Visibility. A Must See!!

1517 Countrywood Ln. Escalon, 3bd/2bth/1987sqft/5,998sqft lot

$575,000 – Single-Story Home in Escalon. Almost 2000sf with a Big Living Room, Big Kitchen, and Big 3 Car Garage. This Home was Built in 2014 by Lafferty Homes. Huge Island with lots of Cabinetry featuring Granite Counters, Big Pantry, and Rich-Cherry Colored Cabinets with SS Appliances. Master Bedroom is Big with Tub, Shower, & Walk-in Closet. Tile Floors throughout. Inside Laundry. Cozy Backyard. A Must See!

Property Features

Bedrooms

- Bedrooms: 3

Appliances

- Equipment: Free Standing Gas Range, Dishwasher, Disposal, Microwave

- Laundry Facilities: Cabinets, Inside Room

Other Rooms

- Dining Room, Great Room

- Living Room Features: Great Room

Heating and Cooling

- Cooling Features: Ceiling Fan(s), Central

- Heating Features: Central

Bathrooms

- Full Bathrooms: 2

- Primary Bathroom Features: Shower Stall(s), Double Sinks, Sunken Tub, Walk-In Closet

- Bathroom 1 Features: Double Sinks, Tub w/Shower Over

Interior Features

- Interior Amenities: Main Level : Bedroom(s), Dining Room, Family Room, Master Bedroom, Full Bath(s), Garage, Kitchen, Street Entrance

- Flooring: Tile

Kitchen and Dining

- Dining Room Description: Dining Bar, Dining/Living Combo

- Kitchen Features: Pantry Closet, Granite Counter, Island

Exterior and Lot Features

- Fencing: Back Yard

Land Info

- Lot Description: Auto Sprinkler F&R, Dead End, Secluded, Stream Year Round

- Lot Size Acres: 0.1377

- Lot Size Dimensions: Almost 6000sf

- Topography: Hillside, Lot Sloped

- Lot Size Square Feet: 5998

Garage and Parking

- Garage Spaces: 3

- Garage Description: Garage Door Opener, Garage Facing Front

Home Features

- View: Panoramic, City, Pasture, River, Valley

- Security Features: Carbon Mon Detector, Double Strapped Water Heater, Smoke Detector

Homeowners Association

- Association: No

- Calculated Total Monthly Association Fees: 0

School Information

- Elementary School District: Escalon Unified

- High School District: Escalon Unified

- Middle or Junior School District: Escalon Unified

Other Property Info

- Source Listing Status: Active

- County: San Joaquin

- Cross Street: Swanson Dr

- Directions: from McHenry, take Countrywood. Right on Swanson and Back onto Countrywood. Right Side.

- Source Property Type: Residential

- Home Warranty: No

- Area: Escalon

- Source Neighborhood: 20509

- Parcel Number: 227-680-08

- Postal Code Plus 4: 8407

- Zoning: RES

- Property Subtype: Single Family Residence

- Source System Name: C2C

Farm Info

- Irrigation Source: Public District

Utilities

- Electric: 220 Volts

- Sewer: Sewer Connected, Sewer in Street, In & Connected

- Public

- Water Source: Public

Building and Construction

- Year Built: 2014

- Construction Materials: Stucco, Wood

- Direction Faces: North

- Foundation Details: Slab

- Living Area Source: Assessor Auto-Fill

- Property Age: 10

- Roof: Roof Description: Tile

- Levels or Stories: 1

- Structure Type: Detached

- House Style: Contemporary

SOLD – 4837 Faith Home Rd. #166 Ceres

Mobile Home that’s Turnkey and Ready to Move into! Approx. 1344sf with 2 Bedrooms and 2 Full Baths. Located near the Park of the Clubhouse with Pool and BBQ amenities. Laminate floors throughout. Carport for Two Cars. Close to Schools and Highway Access.

Price Change -19890 W Campbell St. Hilmar, 3bd/2bth/1121sf/5,998sf lot

Price Change $385,000 – Great Starter Home in Hilmar! Over 1121sf with 3 Bedrooms and 2 Full Baths. Good Size Yard with a 2 Car Garage. Open Living Room. Windows, Roof, HVAC, and Bathroom have been updated through the years. This property is at the end of Campbell Street, Dead End Street.

Property Features

Bedrooms

- Bedrooms: 3

Appliances

- Equipment: Dishwasher, Disposal, Free Standing Electric Range

- Laundry Facilities: In Garage

Heating and Cooling

- Cooling Features: Ceiling Fan(s), Central

- Heating Features: Central

Bathrooms

- Full Bathrooms: 2

- Primary Bathroom Features: Shower Stall(s), Tile

- Bathroom 1 Features: Tile, Tub w/Shower Over

Interior Features

- Interior Amenities: Main Level: Bedroom(s), Dining Room, Family Room, Master Bedroom, Full Bath(s), Garage, Kitchen

- Flooring: Carpet, Laminate, Tile

Kitchen and Dining

- Dining Room Description: Dining/Family Combo

- Kitchen Features: Ceramic Counter, Tile Counter

Other Rooms

- Living Room Features: Great Room

Land Info

- Lot Description: Auto Sprinkler Front

- Lot Size Acres: 0.1377

- Lot Size Square Feet: 5998

Garage and Parking

- Garage Spaces: 2

- Garage Description: Attached, Garage Facing Front, Workshop in Garage

Homeowners Association

- Association: No

- Calculated Total Monthly Association Fees: 0

School Information

- Elementary School District: Hilmar Unified

- High School District: Hilmar Unified

- Middle or Junior School District: Hilmar Unified

Other Property Info

- Source Listing Status: Active

- County: Merced

- Cross Street: Lander

- Directions: Hilmar. On Lander to Campbell which is in front of Hilmar High School.

- Source Property Type: Residential

- Area: Hilmar

- Source Neighborhood: 20417

- Parcel Number: 017-190-013-000

- Postal Code Plus 4: 9380

- Zoning: SFR

- Property Subtype: Single Family Residence

- Source System Name: C2C

Utilities

- Electric: 220 Volts

- Sewer: In & Connected, Public Sewer

- Public

- Water Source: Public

Building and Construction

- Year Built: 1972

- Construction Materials: Stucco, Frame

- Direction Faces: West

- Foundation Details: Raised

- Living Area Source: Assessor Auto-Fill

- Property Age: 52

- Roof: Roof Description: Composition

- Levels or Stories: 1

- Structure Type: Detached

- House Style: Ranch

Home Features

- Security Features: Carbon Mon Detector, Double Strapped Water Heater, Smoke Detector

Should I Wait for Mortgage Rates To Come Down Before I Move?

If you’ve got a move on your mind, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you.

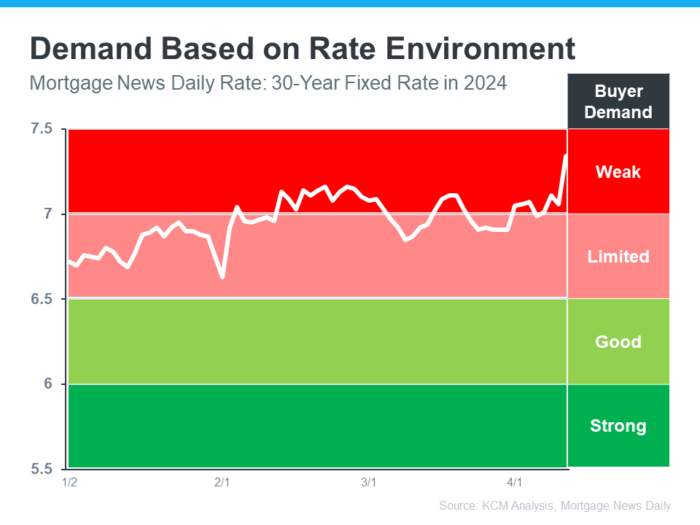

In the housing market, there’s a longstanding relationship between mortgage rates and buyer demand. Typically, the higher rates are, you’ll see lower buyer demand. That’s because some people who want to move will be hesitant to take on a higher mortgage rate for their next home. So, they decide to wait it out and put their plans on hold.

But when rates start to come down, things change. It goes from limited or weak demand to good or strong demand. That’s because a big portion of the buyers who sat on the sidelines when rates were higher are going to jump back in and make their moves happen. The graph below helps give you a visual of how this relationship works and where we are today:

As Lisa Sturtevant, Chief Economist for Bright MLS, explains:

“The higher rates we’re seeing now [are likely] going to lead more prospective buyers to sit out the market and wait for rates to come down.”

Why You Might Not Want To Wait

If you’re asking yourself: what does this mean for my move? Here’s the golden nugget. According to experts, mortgage rates are still projected to come down this year, just a bit later than they originally thought.

When rates come down, more people are going to get back into the market. And that means you’ll have a lot more competition from other buyers when you go to purchase your next home. That may make your move more stressful if you wait because greater demand could lead to an increase in multiple offer scenarios and prices rising faster.

But if you’re ready and able to sell now, it may be worth it to get ahead of that. You have the chance to move before the competition increases.

Bottom Line

If you’re thinking about whether you should wait for rates to come down before you move, don’t forget to factor in buyer demand. Once rates decline, competition will go up even more. If you want to get ahead of that and sell now, talk to a real estate agent.

Source: keepingcurrentmatters.com ~ Image: Canva Pro

PRICE CHANGE – 1953 El Camino Dr. Turlock, 3bd/2bth/1532sf/6460sf lot

$524,900 – El Camino Drive… The Heart of Turlock. This Charming Home features Wood Flooring, Detailed Stucco interior finishes, Remodeled Kitchen, and Remodeled Bathrooms. Over 1500sf with 3 Bedrooms and 2 Full Baths. 2 Car Garage off the Alley with Tall Doors and Cabinets. The Kitchen has Corian Counters, Designer Cabinetry with Custom Glass and Hardware, & Stainless Appliances with Commercial Gas Range. Large Family Room with Fireplace with Formal Dining Area. Den/Bonus for Additional Living Spaces. Good Size Backyard with Lounging Areas near the KOI Pond, Wood Decking, and Privacy. All Bedrooms are Good Size with Hardwood Floors throughout with Closet Organizers. Around the Corner from Julien Elementary and Turlock High School. This is a Turn-Key Home.. This Custom ERA of a Home is hard to duplicate with all of these Newer Windows, HVAC, Updated Kitchen, and Updated Bathroom with a touch of Class. A Must See!

Property Features

Bedrooms

- Bedrooms: 3

- Primary Bedroom Features: Walk-In Closet

Appliances

- Equipment: Free Standing Gas Range, Built-In Gas Range, Compactor, Dishwasher, Disposal, Microwave, Wine Refrigerator

- Laundry Facilities: Cabinets, Inside Room

Other Rooms

- Master Bathroom, Den, Great Room

Heating and Cooling

- Cooling Features: Central

- Heating Features: Central

Bathrooms

- Full Bathrooms: 2

- Primary Bathroom Features: Shower Stall(s), Tile

- Bathroom 1 Features: Shower Stall(s), Tile

Interior Features

- Interior Amenities: Main Level : Bedroom(s), Dining Room, Family Room, Master Bedroom, Kitchen

- Flooring: Tile, Wood

- Window Features: Dual Pane Full

Kitchen and Dining

- Dining Room Description: Dining/Family Combo, Formal Area

- Kitchen Features: Pantry Cabinet, Kitchen/Family Combo

Exterior and Lot Features

- Fencing: Back Yard

- Other Structures: Outbuilding

Pool and Spa

- Spa: No

Land Info

- Lot Description: Auto Sprinkler F&R, Landscape Back, Landscape Front

- Lot Size Acres: 0.1483

- Lot Size Dimensions: Approx. 6460sf

- Topography: Level

- Lot Size Square Feet: 6460

Garage and Parking

- Garage Spaces: 2

- Garage Description: Attached, RV Garage Attached, Garage Door Opener, Garage Facing Rear

Home Features

- View: City

- Security Features: Carbon Mon Detector, Double Strapped Water Heater, Smoke Detector

Homeowners Association

- Association: No

- Calculated Total Monthly Association Fees: 0

School Information

- Elementary School District: Turlock Unified

- High School District: Turlock Unified

- Middle or Junior School District: Turlock Unified

Other Property Info

- Source Listing Status: Active

- County: Stanislaus

- Cross Street: Grayson and Paradise

- Directions: on El Camino. Between El Paseo and Johnson.

- Source Property Type: Residential

- Area: Turlock NE, No of Canal, E of Ge

- Source Neighborhood: 20302

- Parcel Number: 051-025-046-000

- Postal Code Plus 4: 3524

- Zoning: RES

- Property Subtype: Single Family Residence

- Source System Name: C2C

Utilities

- Electric: 220 Volts

- Sewer: In & Connected, Public Sewer

- Cable Available

- Water Source: Public

Building and Construction

- Year Built: 1953

- Construction Materials: Stucco, Wood

- Direction Faces: South

- Foundation Details: Raised, Slab

- Levels: One

- Living Area Source: Assessor Auto-Fill

- Property Age: 71

- Property Condition: Updated/Remodeled, Original

- Roof: Roof Description: Composition

- Levels or Stories: 1

- Structure Type: Semi-Custom

6318 S Prairie Flower Rd. Turlock, 10ac Ranchette! 2 Bds/2Bth Mobile Home

$499,900 – 10 Acre Ranchette!! Currently with a Mobile Home at Approx. 1200sf, 2 Bedrooms and 2 full Baths. Ag Land, Building Site, Trees, and on the Edge of Hilmar with Turlock Address. Nonpareil and Aldrich with a Blue Diamond Contact. 10hp with Booster Pump off the TID Canal on One Set, Double Drip.

- Association: No

- Association Fee: 0

- Horse Property: Yes

- Horse Property Features: See Remarks

- Lot Size Acres: 10.4200

- Topography: Agricultural Leveled, Trees

- Zoning Description: 2nd Unit Possible, Agricultural, Orchard, Agricultura

- APN: 057-012-004-000

- County: Stanislaus

- Cross Street: Elaine

- Distance To Phone Service: Phone To Site

- Water Source: Domestic Well With Pump

- Elementary School District: Turlock Unified

- Middle or Junior School District: Turlock Unified

- School District (County): Stanislaus

- Senior High School District: Turlock Unified

- Crops: Almond, Plantable, See Remarks

- Development Status: See Remarks

- Directions to Property: Highway 99 to Lander-Southbound. Right on Bradbury. Left on Prairie Flower. Left side once you past the Canal. North of Elaine.

- Elevation: 0

- Irrigation: District, Drip System, Pipeline

- Lot Features: Building Pad, See Remarks

- Lot Size Dimensions: Approx. 10.4 Acres

- Lot Size Square Feet: 453895.00

- Minimum Bldg SqFt: 0

- Other Structures: Modular Home

- Primary Residence: Mobile/Modular, 31+ Years Old, Bath 2+, Under 1500 SqFt, Bedrooms 2, Family Room

- Sewer: Septic Tank, Sewer Connected

- Special Listing Conditions: None

- Vegetation: Orchard

- View Description: Orchard, Hills

- Zoning: AG

- Current Use: Agricultural, Farm, Ranch, Livestock, Single Family, Tree Farm, Orchard

- Distance To Electric: Electricity To Site

- Road Frontage Type: County Road, See Remarks

- Utilities: Phone Connected, Propane Tank Leased

0 Santa Nella Blvd. Santa Nella

$10,395,000 – 75.95 Acres of Prime Real Estate Along Highway 33 where the High Traffic Zone on Highway 33 and Interstate 5 meet. This Location has been expanding and growing at a Fast Pace. This property has a Good Ag Well which would contribute to the development of this property. This Property is also in the San Luis Water District for Farming Purposes. Here’s your opportunity to have a large stake in this Claim. It’s Triple Zoned: Zoned C-2 (General Commercial) along highway 33 (Santa Nella Blvd). The Southeast corner is Zoned R-4, and Northeast corner is Zoned R-3. Currently Farmed, Leveled, and Ready for Your Project.

- Lot Size Acres: 75.9500

- Topography: Agricultural Leveled

- Zoning Description: Commercial, Multi-Residential, See Remarks, Other

- APN: 070-100-011-000

- County: Merced

- Cross Street: Plaza and Fahey

- Water Source: Agricultural Well, Irrigation District

- Elementary School District: Gustine Unified

- Middle or Junior School District: Gustine Unified

- School District (County): Merced

- Senior High School District: Gustine Unified

- # of Lots: 0

- Commission To Buyer Broker: 2.5

- Commission Type: %

- Crops: Row Crops

- Development Status: Raw Land, Farm Land

- Directions to Property: On Highway 33 (Santa Nella Blvd). Just South Of Fahey, East side of Highway 33. This property is Just North of Interstate 5 and Highway 33 interchange.

- Elevation: 0

- Irrigation: Deep Water Turbine, District

- Lot Features: Shape Regular, See Remarks

- Lot Size Dimensions: Approx. 75.95

- Lot Size Square Feet: 3308382.00

- Minimum Bldg SqFt: 0

- Other Structures: None

- Sewer: None

- Special Listing Conditions: None

- Vegetation: Crop(s), Grassed, Other

- View Description: Panoramic

- Zoning: C-2, R-4, R-3

- Current Use: Agricultural

- Distance To Electric: Electricity To Site

- Road Frontage Type: Highway

- Utilities: Public, Other

15490 Atwater Jordan Rd. Livingston, 304ac Ag Land

$7,305,600 – 304 Acres with Solar Power, Ag Business Capability with Certified Organic Crops of Rye, Potatoes, and Other Specialty Crops. Irrigation Infrastructures are in place with Main Irrigation lines at 6-inch main pipes and 8-inch main pipes running to laterals with a 300′ spacing with risers. They currently have 4 Ag Wells; #1 60hp, #2 60hp, #3 40hp, #4 100hp. Total Irrigation water is 3200gpm. Class 2 Irrigation Water available from MID using a 50hp Booster Pump off Howard canal, Approx. 550gpm. The Class 2 Contract is a 9-year contract. Solar Panels that are owned, and used to offset the 7 electrical meters and 15,000sf Metal Shop Building with 2 loading Docks 8 bins height capacity for Storage with Fans, Insulated, Multiple Roll-up doors, breakroom, Bathrooms, and More. There’s a Separate 30X200 Storage Shed, a 3311sf custom-built home, a Modular Home, an office, and More. On A Squared Country Block surrounded by Country Roads.

- Lot Size Acres: 304.5519

- Topography: Agricultural Leveled

- Zoning Description: Agricultural, Agricultural/Residential

- APN: 049-050-009-000

- County: Merced

- Cross Street: Washington, Sunset, and Howard

- Distance To Phone Service: Phone To Site

- Water Source: Agricultural Well, Domestic Well Storage Tank, Domestic Well With Pump

- Elementary School District: Livingston Union

- Middle or Junior School District: Livingston Union

- School District (County): Merced

- Senior High School District: Merced Union High

- Crops: Plantable, Row Crops, Vegetables, Grain

- Development Status: Raw Land, Farm Land, Improvements Complete, See Remarks

- Directions to Property: On A Squared Country Block surrounded by Country Roads…This Property Fronts Howard, Sunset, Washington, and Atwater Jordan.

- Elevation: 0

- Irrigation: Deep Water Turbine, Domestic Well, Drip System, Pipeline, Well, See Remarks

- Lot Features: Building Pad, Shape Regular, See Remarks

- Lot Size Square Feet: 13266281.00

- Minimum Bldg SqFt: 0

- Other Structures: Barn(s), Modular Home, Barn w/Electricity, Shop, Garage(s)

- Primary Residence: 0-30 Years Old, Over 1500 SqFt

- Sewer: Septic Tank

- Special Listing Conditions: None

- Vegetation: Crop(s), Grassed

- View Description: Panoramic

- Zoning: Ag

- Current Use: Agricultural, Plantable, Farm, Mixed Use

- Distance To Electric: Electricity To Site

- Road Frontage Type: County Road

- Utilities: Phone Connected, Propane Tank Owned

106-Acres Gates Rd, Modesto

$5,908,560 – Young Almonds in West Modesto. Within the Modesto Irrigation Water District with a 50Hp Booster Pump, 600gpm Deep Well, and MID Flood Water with Irrigation Gates Available. Orchard is on Double Line Drip, irrigates in 3 sets with Booster Pump. 35 Acres Independence Planted in 2016. 42 Acres of Nonpariel-50%, Aldrich-25%, and Monterey-25% Planted in 2016. 23 Acres of Nonpariel-50%, Aldrich-25%, and Monterey-25% Planted in 2019. Orchard Well-Cared For and Well-Maintained. Crop records are available, Blue Diamond has been the processor and handler for this orchard. This Ranch is Multiple Parcels. A Must See!

- Lot Size Acres: 105.5100

- Topography: Agricultural Leveled

- Zoning Description: Agricultural, Orchard, Agricultural/Residential, Farm

- APN: 012-025-063-000

- County: Stanislaus

- Cross Street: Grayson & Paradise

- Water Source: Agricultural Well, Irrigation District

- Elementary School District: Shiloh

- Middle or Junior School District: Shiloh

- School District (County): Stanislaus

- Senior High School District: Modesto City

- Crops: Almond, Row Crops

- Development Status: Farm Land

- Directions to Property: On the Corner of Gates and Shoemake. Northeast Corner.

- Elevation: 0

- Irrigation: Public, Public District, Deep Water Turbine, District, Drip System, Pipeline

- Lot Features: Corner, Shape Irregular

- Lot Size Square Feet: 4596016.00

- Minimum Bldg SqFt: 0

- Sewer: None

- Special Listing Conditions: None

- Vegetation: Crop(s), Trees Many

- View Description: Orchard

- Zoning: RES

- Current Use: Agricultural, Ranch, Orchard

- Distance To Electric: Electricity To Site

- Road Frontage Type: County Road

- Utilities: Public, None